Payback method

The payback method is used to determine how long it will take for future cash inflows from the project to equal the initial cost of the project. The method as the name implies establishes the payback period of each project. As the method stands, the shorter the payback period the better. It is often argued that industries where products get outdated quickly such as fashion and computers will prefer to use the payback method. The reason being that it is critical that the initial cost of the project is recovered quickly. In any case, most organisations have a set of standard payback periods for each investment project. They will in most cases compare the payback period from each investment project with the pre-determined payback period. Any project that falls short of the standard payback period will be rejected.

Evidence has shown that apart from this fact, managers will prefer to use the method as an initial screening process because it is easy to use and understand by them. One important disadvantage of the method is that it ignores the time value of money. It also ignores profitability of the project but stresses the importance of liquidity. Whether this is an advantage or not will depend on the area of interest to the individual concerned.

Accounting Rate of Return (ARR)

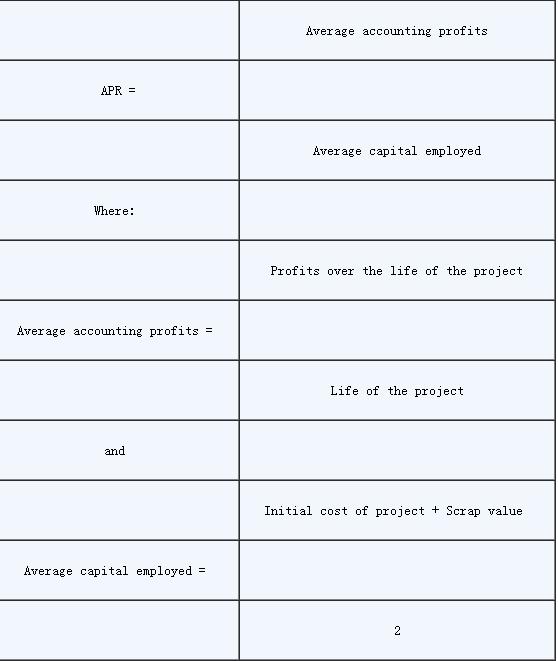

This method ARR is also referred to by some other names such as Return on Investment (ROI), Return on Capital Employed (ROCE). The most important thing to remember about this method is that it establishes rates of return on projects. There are different ways of determining a rate of return. For the purposes of this article, we will use Average Accounting Profits divided by Average Capital Employed multiplied by 100. That is:

When there are two or more investment projects, rates of return are compared. A project, which has a higher rate, will be recommended, as this is an indication that it will give a higher return to the investing entity compared with the one with a lower rate.

,我们将会及时处理。

,我们将会及时处理。