小编为各位ACCA学员整理了P1科目复习指导,希望大家查漏补缺,对考试有所帮助。

Relevant Codes

4.1 Driving forces of development of corporate governance codes

<1>Increasing internationalization and globalization, require free movement of capital and security of investment

<2>Different treatment of domestic and foreign investor caused them to call for parity of treatment

<3>Issues concerning with financial reporting, greater transparency and reduction in risks faced by investors. Lack of confidence perceived in financial reporting and in the ability of auditors to provide reasonable assurances which required by the users of financial statements.

<4>Evidence that poor governance will lead to poor performance, investors are willing to pay a significant premium for companies that are well governed.

<5>High profile corporate scandals and collapses require the need to reduce risk and potential losses to shareholders

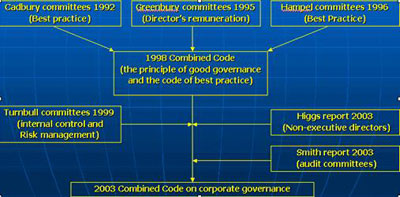

4.2 Developments of corporate governance codes

4.2.1 UK codes

<1>Cadbury report 1992 (the financial aspects of corporate governance/best practice)

a. The board of directors (responsible for corporate governance):

(a) Meet on a regular basis

(b)Retain full control over the company and monitor executive management

(c) Division of responsibly at the head of a company, especially between chairman and CEO

(d) At least three independent non-executive directors on the board

(e) Shareholders/Institutional investors

(f) The need for greater dialogue with director and respond to the needs

(g) Make considered use of their votes

(h) Improve corporate governance

b. Audit and accountability (duties of audit committee):

(a) Liaison with external auditors

(b) Supervise internal audit

(c) Review the annual account and internal control

(d) Conduct risk management and investigation

(e) Ensure annual report be presented in a balanced and understandable assessment of the company’s position

c. Provision about the length of directors’ service contracts and disclosure of remuneration

<2>Greenbury code 1995 (directors’ remuneration)

a. Determination of directors’ pay and detailing disclosures to be given in the annual reports and accounts

(a) Remuneration committee should be comprised only of NEDs

(b)Remuneration committee determines executive directors’ remuneration

(c) Directors’ service contract should be limited to one year

<3>Hampel report 1998 (corporate governance/best practice)

a. It contains a statement of how the company applies the corporate governance practices

b. It aims to:

(a) Restrict the regulatory burden on companies

(b) Substituting principles for detail ‘comply or explain basis’

c. Content (explain the policy of best practice):

(a) Principles of corporate governance

(b) The role of directors and shareholders

(c) Directors’ remuneration

(d) Accountability and audit

<4>Combined code – London stock exchange (1998, 2003, 2006)

<5>Turnbull report 1995/2005 (internal control and risk management)

a. Develop and maintain appropriate internal control systems to reduce risk

b. Directors should review their systems of internal control and report these to shareholders

<6>Higgs report 2003 (NEDs)

a. The role of NEDs in the board, nomination committee, remuneration committee and audit committee

<7>Smith report 2003 (audit committee)

a. The relationship between the auditor and the companies they audit

b. The role and responsibility of audit committee

4.2.2 US codes (Sarbanes-Oxley Act)

<1>Background: the Enron Scandal

a. A lack of the transparency in the accounts

b. Ineffective corporate governance arrangement

c. Inadequate scrutiny by the external auditor

d. Information asymmetry

,我们将会及时处理。

,我们将会及时处理。