Question:

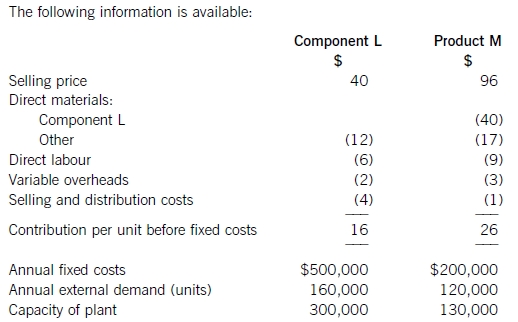

A manufacturing company,Man Co,has two divisions:Division L and Division M. Both divisions make a single standardised product. Division L makes component L,which is supplied to both Division M and external customers. Division M makes product M using one unit of component L and other materials. It then sells the completed product M to external customers. To date,Division M has always bought component L from Division L.

Division L charges the same price for component L to both Division M and external customers. However,it does not incur the selling and distribution costs when transferring internally.

Division M has just been approached by a new supplier who has offered to supply it with component L for $37 per unit. Prior to this offer,the cheapest price which Division M could have bought component L for from outside the group was $42 per unit.

It is head office policy to let the divisions operate autonomously without interference at all.

Required:

(a)Calculate the incremental profit/(loss)per component for the group if Division M accepts the new supplier‘s offer and recommend how many components Division L should sell to Division M if group profits are to be maximised.

(b)Using the quantities calculated in (a)and the current transfer price,calculate the total annual profits of each division and the group as a whole.

(c)Discuss the problems which will arise if the transfer price remains unchanged and advise the divisions on a suitable alternative transfer price for component L.

Answer:

(a)Maximising group profit

Division L has enough capacity to supply both Division M and its external customers with component L.

Therefore,incremental cost of Division M buying externally is as follows:

Cost per unit of component L when bought from external supplier:$37

Cost per unit for Division L of making component L:$20.

Therefore incremental cost to group of each unit of component L being bought in by Division M rather than transferred internally:$17 ($37-20).

From the group’s point of view,the most profitable course of action is therefore that all 120,000 units of component L should be transferred internally.(b)Calculating total group profit.

(b)Calculating total group profit

(c)Problems with current transfer price and suggested alternative

The problem is that the current transfer price of $40 per unit is now too high. Whilst this has not been a problem before since external suppliers were charging $42 per unit,it is a problem now that Division M has been offered component L for $37 per unit. If Division M now acts in its own interests rather than the interests of the group as a whole,it will buy.

component L from the external supplier rather than from Division L. This will mean that the profits of the group will fall substantially and Division L will have significant unused capacity. Consequently,Division L needs to reduce its price. The current price does not reflect the fact that there are no selling and distribution costs associated with transferring internally,i.e. the cost of selling internally is $4 less for Division L than selling externally. So,it could reduce the price to $36 and still make the same profit on these sales as on its external sales. This would therefore be the suggested transfer price so that Division M is still saving $1 per unit compared to the external price. A transfer price of $37 would also presumably be acceptable to Division M since this is the same as the external supplier is offering.

,我们将会及时处理。

,我们将会及时处理。